On June 1, President Biden declared June National Homeownership Month, 2021. Recognizing that the “aspiration to own a home is connected deeply to the American Dream,” the President has laid out ambitious plans to “spur construction and rehabilitation of more than 500,000 homes for buyers of more modest means.” The American Jobs Plan, currently under negotiations in Washington, D.C. could help equalize racial disparities in homeownership rates.

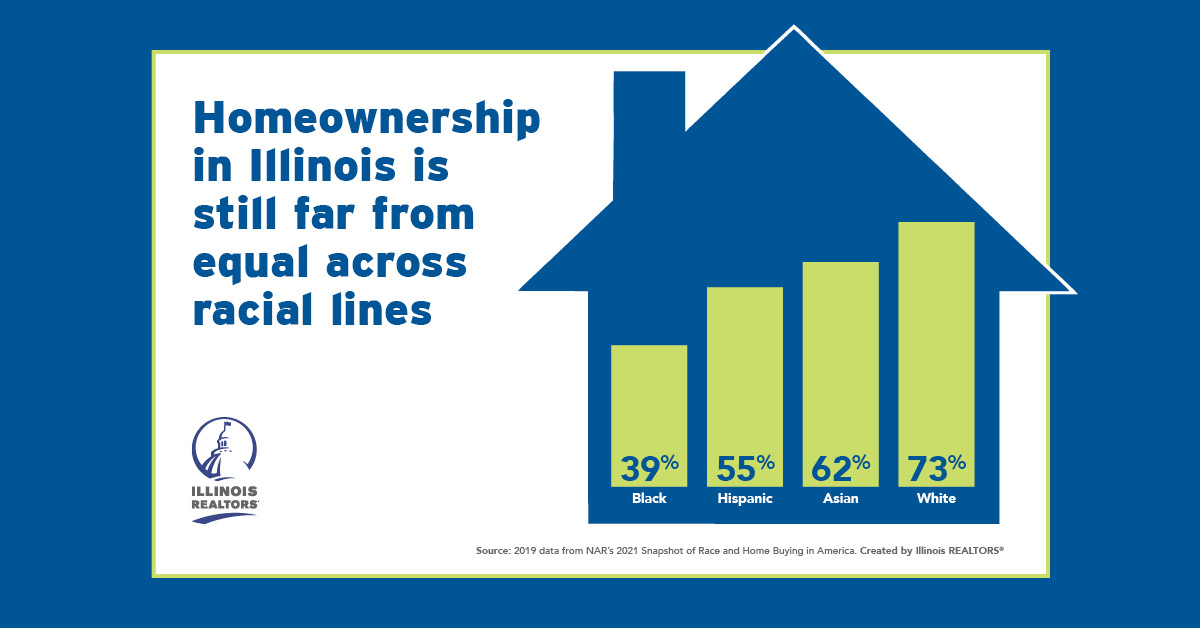

Illinois REALTORS® called attention to the homeownership gaps in Illinois, releasing the “Homeownership Rates by Race” infographic. The visual aid was created using National Association of REALTORS® data and demonstrates the stark disparities resulting from many decades of racist housing policies at the local, state and federal levels such as redlining and deed restrictions. Illinois REALTORS® is also shining a spotlight on Real Estate Industry Partners and their efforts to address these gaps. The groups lead policy and advocacy efforts to increase homeownership and publish annual reports tracking progress through homeownership and demographic data.

The Asian Real Estate Association of America (AREAA) led successful efforts to get the U.S. Census Bureau to change how they track homeownership data for the Asian Americans and Pacific Islander (AAPI) community. Previously aggregated under the option of “other,” AREAA’s “No Other” campaign lobbied Congress and the U.S. Census Bureau to create a unique category for AAPI homeownership in their quarterly report. Locally, the Greater Chicago Chapter partnered with Illinois REALTORS® to bridge language barriers to homeownership by releasing translated consumer documents. In Illinois, the Asian homeownership rate is 62 percent, slightly higher than the national rate of 60.7 percent.

The National Association of Hispanic Real Estate Professionals (NAHREP) has outlined access to credit, increasing housing inventory and immigration reform as key policy priorities. According to its website, “Latinos accounted for 40.4 percent of all household formation growth over the past 10 years.” The organization further projects that “between 2020-2040, 70 percent of new homeowners will be Latino.” At 55 percent in Illinois, the Hispanic homeownership rate is higher than the national rate of 48.1 percent.

The National Association of Real Estate Brokers (NAREB) points out that, nationally, Black homeownership is on the rise (42 percent) but still has not reached pre-foreclosure crisis peak. NAREB is laser focused on substantive policy changes that will help untangle the systemic barriers facing Black consumers. At 39 percent, the homeownership rate for Black Illinoisans should be a call to action for policy makers at all levels.

One of the greatest current challenges to homeownership in Illinois is inventory. Housing inventory was falling pre-pandemic and COVID-19 only exacerbated the trend. Low inventory, coupled with historically low interest rates and wildly increasing construction material costs have pushed up home pricing and forced fierce competition for homebuyers in Illinois. The need is particularly acute at lower price points which makes it even more difficult to increase homeownership rates.

While additional solutions are needed, Illinois REALTORS® applauded the passage of an Affordable Housing Omnibus by the state legislature on May 31 which is expected to be signed by Governor J.B. Pritzker. The legislation directs significant grant dollars toward the construction of new affordable units, creates a state tax credit for affordable housing development and will ease the property tax burden on housing units that are held at affordable rates.