There’s been something missing from property tax assessments. Until now, distressed property sales and the effect they have on area property values were not considered in the assessment process.

The Illinois Association of REALTORS® supported a bill that sought to amend the Illinois Property Tax Code and include distressed property sales into property tax assessments. Senate Bill 3334, which became law on July 16, will allow for a more complete and balanced picture of property values in a community. Property owners who seek to appeal their property taxes will be armed with the most accurate information available.

The IAR Governmental Affairs team provided real estate expertise and knowledge needed to craft this legislation, which is meant to result in more accurate property tax assessments.

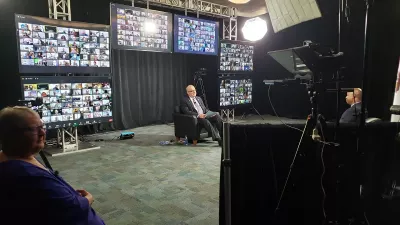

Watch the video below for more details regarding the new law:

Create professional development programs that help REALTORS® strengthen their businesses.

Create professional development programs that help REALTORS® strengthen their businesses.

Protect private property rights and promote the value of REALTORS®.

Protect private property rights and promote the value of REALTORS®.

Advance ethics enforcement programs that increase REALTOR® professionalism.

Advance ethics enforcement programs that increase REALTOR® professionalism.

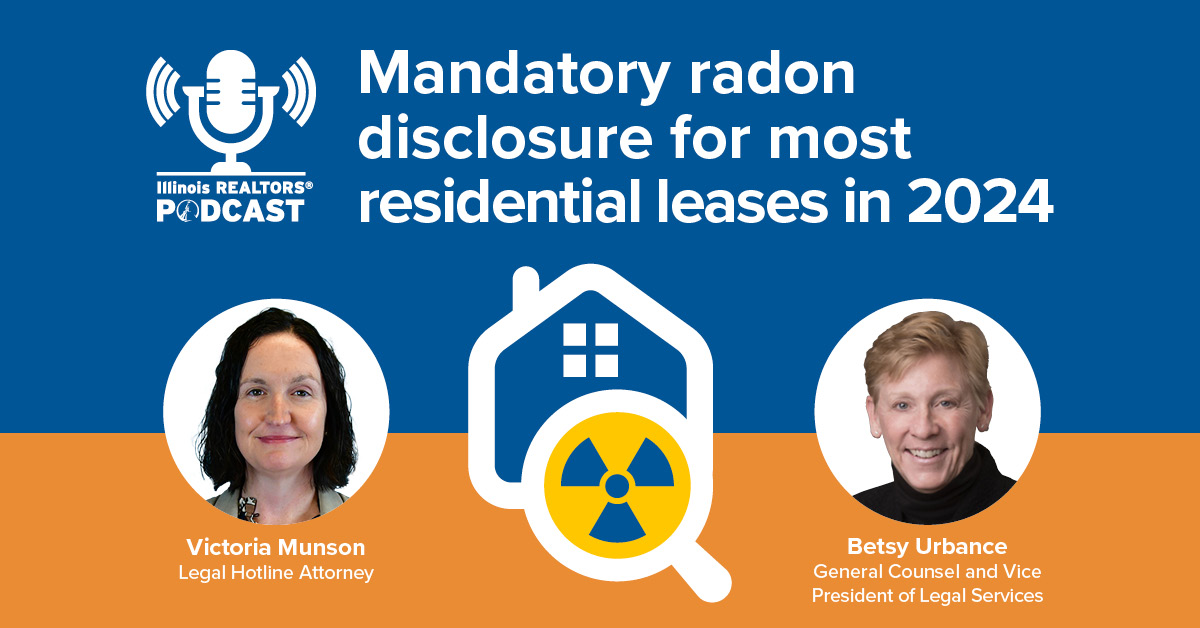

Protect REALTORS® by providing legal guidance and education.

Protect REALTORS® by providing legal guidance and education. Stay current on industry issues with daily news from Illinois REALTORS®, network with other professionals, attend a seminar, and keep up with industry trends through events throughout the year.

Stay current on industry issues with daily news from Illinois REALTORS®, network with other professionals, attend a seminar, and keep up with industry trends through events throughout the year.