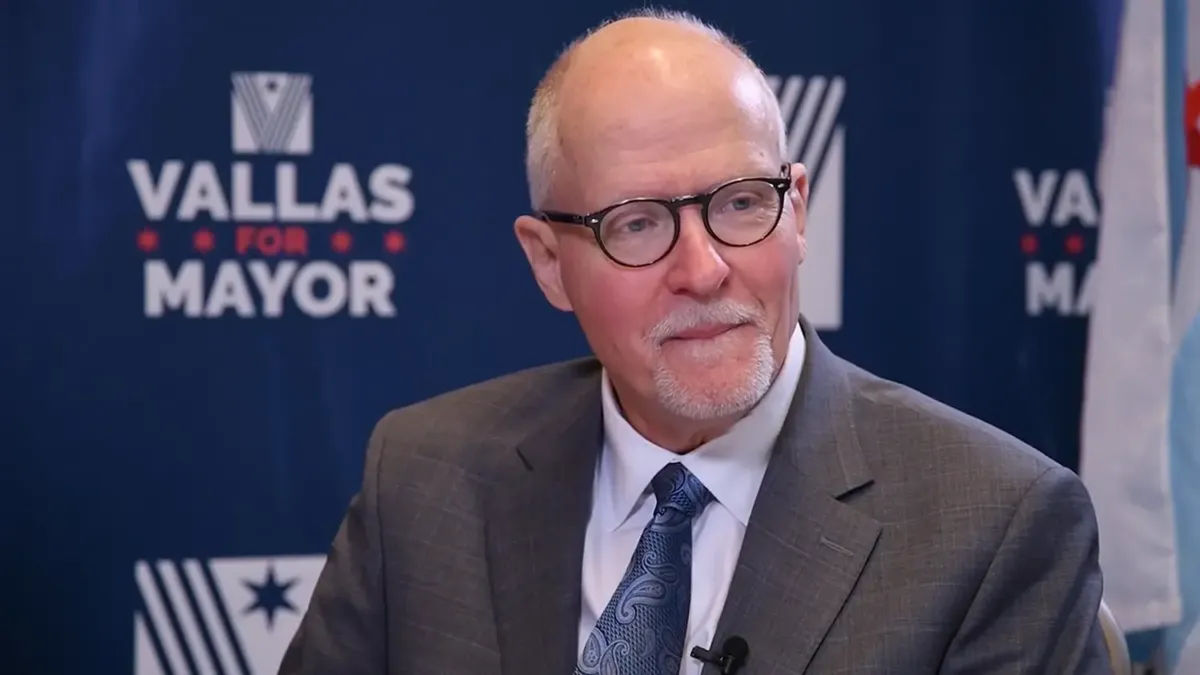

One of the two candidates for Chicago Mayor, Paul Vallas, has promised that he would cap property taxes if elected. In a one-on-one interview with Illinois REALTORS® in the lead up to next week’s runoff election, Vallas said he would impose a property tax cap to protect homeowners and the owners of apartment buildings.

During the interview, Vallas said he wanted the city’s regulatory departments to be more business friendly. Doing so, he argued, would make the city more friendly to REALTORS® and property owners alike.

Gentrification is often seen negatively as new development in certain neighborhoods leads to higher property tax assessments for residents who have long lived in those neighborhoods. To combat this, Vallas said he believes the city should cap individual property tax assessments. “If you want to protect against gentrification and if you want to control rents, the most effective way to do that is to cap individual property taxes.”

As housing inventory has continued to dwindle across the state, rents have increased to meet the additional demand. While there are proposals in Springfield to lift the state’s ban on rent control, Vallas called the idea “counter-productive” and compared it to an unfunded mandate. When mandates like rent control are imposed, he said, properties “can barely survive the ever-increasing property taxes,” which will ultimately lead to owners not making improvements or investments in their buildings.

The city’s housing shortage is widespread, but it is particularly acute in the affordable housing sector. In his interview, Vallas said he was a proponent of removing the obstacles to converting unimproved space into affordable units. According to Vallas, there are presently over 120,000 unimproved multifamily spaces that are ready to be converted.

One of the issues Vallas opposed was the proposed “Bring Chicago Home” ordinance, which would increase transfer taxes on certain properties to fund housing initiatives, particularly for the homeless.

“My opponent, who supports the so-called ‘mansion tax’ also wants to impose an income tax… and of course, he wants to impose a head tax [on businesses]. … At the end of the day, $800 million in new tax increases on top of the almost $900 million in property tax increases that have occurred since 2019 – it’s not going to happen.”

To hear more from this candidate, be sure to check out the full interview below.

*Member log-in required to view video

Create professional development programs that help REALTORS® strengthen their businesses.

Create professional development programs that help REALTORS® strengthen their businesses.

Protect private property rights and promote the value of REALTORS®.

Protect private property rights and promote the value of REALTORS®.

Advance ethics enforcement programs that increase REALTOR® professionalism.

Advance ethics enforcement programs that increase REALTOR® professionalism.

Protect REALTORS® by providing legal guidance and education.

Protect REALTORS® by providing legal guidance and education. Stay current on industry issues with daily news from Illinois REALTORS®, network with other professionals, attend a seminar, and keep up with industry trends through events throughout the year.

Stay current on industry issues with daily news from Illinois REALTORS®, network with other professionals, attend a seminar, and keep up with industry trends through events throughout the year.