Illinois saw higher home sales both in December and across 2025, even as inventory remained low and median prices continued to rise, according to data from Illinois REALTORS®.

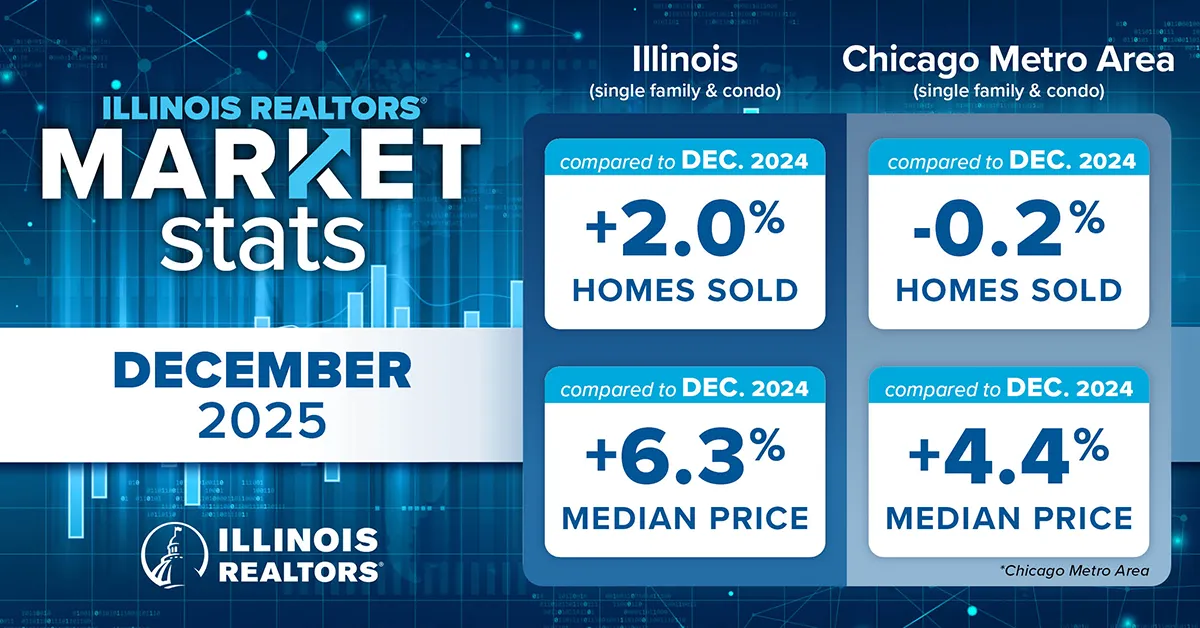

In December 2025, statewide home sales (including single-family homes and condominiums) of 10,237 homes sold was 2.0 percent higher than 10,041 sold in December 2024. The 18,421 homes available for sale statewide in December were 8.2 percent less than the 20,063 homes available in December 2024. The monthly median price of $299,900 in December 2025 was 6.3 percent more than $282,111 in December 2024.

Annual closed sales of 136,650 were 4.2 percent more than 131,194 in 2024. The annual median price of $300,000 was 3.4 percent more than $290,000 in 2024. The median is a typical market price where half the homes sold for more and half sold for less.

“December reflected a market that remains active, with prices holding firm amid continued supply challenges. Across the year, tight inventory was a defining factor shaping the market,” said Jeff Kolbus, president of Illinois REALTORS®, president and owner of RE/MAX Traders Unlimited in Peoria. “In 2026, we expect improvement to be steady, with affordability and mortgage rates continuing to influence outcomes.”

In the nine-county Chicago Metro Area, December 2025 home sales (single-family and condominiums) totaled 6,637 homes sold, down 0.2 percent from December 2024 sales of 6,650 homes. In December 2025, there were 10,801 homes for sale in the Chicago Metro Area, a 11.3 percent decrease from 12,178 homes on the market in December 2024. The median price of a home in the Chicago Metro Area of $355,000 in December 2025 was 4.4 percent greater than $340,000 in December 2024.

The annual home sales in the Chicago Metro Area totaled 89,091, up 0.6 percent from 88,560 in 2024. The 2025 annual median price of a home in the Chicago Metro Area was $366,000, up 4.6 percent from $350,000 in 2024.

“The Institute for Housing Studies’ (IHS) three-month forecast projects that Illinois home sales will decline by approximately 1.8 percent between January and March compared to the same period last year. Home prices are expected to remain strong overall, with March prices projected to be roughly 12 percent higher year over year.,” said Geoff Smith, Executive Director, Institute for Housing Studies at DePaul University in Chicago.

“While recent declines in mortgage interest rates are widely viewed as positive, continued tight inventories and ongoing affordability challenges are likely to constrain homebuying activity in the near term,” Smith said.

The city of Chicago experienced a 0.4 percent year-over-year increase in sales in December 2025 with 1,615 sales, up from 1,609 in December 2024. In December 2025, there were 2,969 homes for sale in the city of Chicago, a 25.5 percent decrease from 3,983 homes on the market in December 2024. The median price of a home in the city of Chicago in December 2025 was $350,000, a 2.9 percent increase from December 2024 when the median price was $340,000.

Annual home sales in the city of Chicago totaled 22,093 in 2025, down 0.1 percent from 22,109 in 2024. The 2025 annual median price of a home in the city of Chicago was $375,000, up 5.6 percent from $354,975 in 2024.

“Chicago’s housing market held steady in December, with closed sales and days on market reflecting steady demand, even as low inventory remains a challenge,” said Lutalo McGee, president of the Chicago Association of REALTORS® and owner and designated managing broker of Ani Real Estate. “Looking toward 2026, we hope to see more inventory enter the market, whether through sellers re-engaging or new construction, which will help meet buyer demand and unlock new opportunities. Also, the downward movement in interest rates are a positive sign.”

Sales and price information are generated by Multiple Listing Service closed sales reported by 18 participating Illinois REALTOR® local boards and associations including Midwest Real Estate Data LLC data as of Jan. 7, 2026, for the period December 1 through December 31, 2025. The Chicago Metro Area, as defined by the U.S. Census Bureau, includes the counties of Cook, DeKalb, DuPage, Grundy, Kane, Kendall, Lake, McHenry and Will.

Based on the Freddie Mac data, the monthly average commitment rate for a 30-year, fixed-rate mortgage was 6.19 percent in December 2025, down from 6.24 percent from the month before and down from the December 2024 average of 6.72 percent.

Find Illinois housing stats, data and the January 2026 forecast from the Institute for Housing Studies at DePaul University at www.illinoisrealtors.org/marketstats/.