Illinois median home prices and home sales moved higher in September while available inventory was lower than the year before, according to data from Illinois REALTORS®.

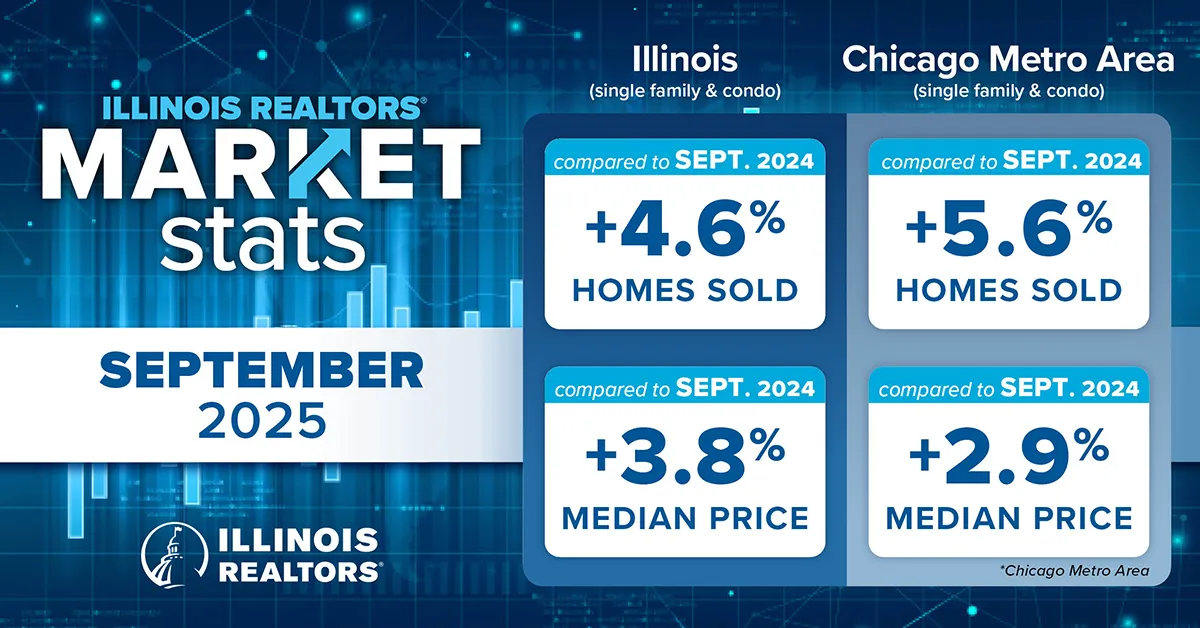

In September 2025, statewide home sales (including single-family homes and condominiums) of 11,375 homes sold was 4.6 percent more than 10,873 sold in September 2024.

The 22,845 homes available for sale statewide in September 2025 were 2.9 percent less than the 23,522 homes available in September 2024. The monthly median price of $301,000 in September 2025 was 3.8 percent higher than $290,000 in September 2024. The median is a typical market price where half the homes sold for more and half sold for less.

“Across Illinois, housing activity remained steady through September, a sign of continued buyer and seller confidence despite ongoing affordability challenges,” said Tommy Choi, 2025 Illinois REALTORS® President and co-founder and owner of Weinberg Choi Residential at Keller Williams ONEChicago.

“What we’re seeing is a market finding balance. A market where preparation, pricing, and patience matter more than ever,” Choi said. “While affordability remains a key concern, these steady gains show that Illinois buyers continue to believe in the long-term value of homeownership.”

In the nine-county Chicago Metro Area, September 2025 home sales (single-family and condominiums) totaled 7,484 homes sold, up 5.6 percent from September 2024 sales of 7,088 homes. In September 2025, there were 14,682 homes for sale in the Chicago Metro Area, a 6.4 percent decrease from 15,693 homes on the market in September 2024. The median price of a home in the Chicago Metro Area of $360,000 in September 2025 was 2.9 percent greater than $350,000 in September 2024.

“The Institute for Housing Studies’ (IHS) three-month forecast projects that Illinois home sales will decline by nearly 4 percent between October and December compared to the same period last year. While home prices are expected to follow typical seasonal patterns and soften through the end of the year, they are projected to remain strong overall ending December nearly 5 percent higher year-over-year,” said Geoff Smith, Executive Director, Institute for Housing Studies at DePaul University in Chicago.

“In September 2025, single-family inventories declined year-over-year for the first time since April 2024, breaking a 16-month streak of gains and highlighting Illinois’ slow recovery toward pre-pandemic inventory levels,” Smith said. “Continued price growth, despite economic uncertainty, highlights the role that persistent tight supply plays in shaping homebuyer affordability across the state.”

The city of Chicago experienced a 5.3 percent year-over-year sales gain in September 2025 with 1,772 sales, up from 1,683 in September 2024. In September 2025, there were 4,290 homes for sale in the city of Chicago, a 22.2 percent decrease from 5,516 homes on the market in September 2024. The median price of a home in the city of Chicago in September 2025 was $360,000, a 3.6 percent increase from September 2024 when the median price was $347,500.

“The nominal increase in closed sales this September likely reflects activity carried over from the end of the summer market,” said Lutalo McGee, president of the Chicago Association of REALTORS® and owner and designated managing broker of Ani Real Estate. “Low inventory continues to drive market conditions, even as homes are spending slightly more time on the market. This is a market where local insight matters, so work with a real estate expert who understands your goals.”

Sales and price information are generated by Multiple Listing Service closed sales reported by 19 participating Illinois REALTOR® local boards and associations including Midwest Real Estate Data LLC data as of Oct. 7, 2025, for the period September 1 through September 30, 2025. The Chicago Metro Area, as defined by the U.S. Census Bureau, includes the counties of Cook, DeKalb, DuPage, Grundy, Kane, Kendall, Lake, McHenry and Will.

Based on the Freddie Mac data, the monthly average commitment rate for a 30-year, fixed-rate mortgage was 6.35 percent in September 2025, down from 6.59 percent from the month before and up from the September 2024 average of 6.18 percent.