Expanded Responsibilities being proposed for Designated Managing Broker under RELA 10-55

Designated Managing Brokers responsibilities would increase under proposed administrative rules changes to the Real Estate License Act (“RELA”), which is now available for your review in the Illinois Register.

Anneliese Fierstos

Illinois REALTORS® Legal Hotline Attorney

Under the proposed new RELA rules, a designated managing broker (DMB) is responsible for supervising all licensees in that office. The role of the DMB is further clarified by Section 1450.705 (c) and (d) of the proposed rules, which should be considered in conjunction with RELA in evaluating the role of the DMB.

DMB supervisory responsibilities include (and have always included):

- Implementation of company policies;

- Training of sponsored licensees/ unlicensed employees/assistants on company policies and RELA;

- Assisting licensees with transactions;

- Supervising all special accounts, including earnest money and escrow accounts;

- Supervising all advertising, in any media, of any service for which a license is required;

The expanded DMB supervisory responsibilities for new brokers, who have not completed 45 hours of required post-license education, include:

- Direct handling of all earnest money, escrow and contract negotiations;

- Direct involvement and oversight during contract negotiations involving the purchase, sale or lease of real estate;

- Direct oversight and approval of all advertising;

- Playing a role in all aspects of the transaction in which the company intends to be legally bound (e.g. the listing agreement) because licensees that have not completed 45 hours of post-licenses education have no authority to bind the sponsoring broker.

A DMB may consider establishing office policies to implement the new supervisory responsibilities. It may be impractical or impossible for a DMB to actually have one-on-one physical presence with each new broker licensee and their transactions. Section 1450.705(d) of the proposed rules clarifies this requirement and states that “[o]versight can be accomplished through physical presence of the designated managing broker or by electronic means, so long as oversight can be effectively demonstrated to the department in the context of an audit or investigation.”

Additional requirements have been outlined for DMB’s handling escrow moneys for transactions involving new broker licensees:

- DMB must have an established procedure for delivery directly from the new broker licensee to the DMB, their accountant, or the office manager on the same day or by the next business day following the transaction or delivery of the escrow money as set forth in the contract (in accordance with 1450.750 of the proposed rules) and

- Electronic escrow funds transfers must be directly supervised by the DMB which could be demonstrated by making sure the DMB is in the distribution chain when funds are transferred (in accordance with 1450.750 of the proposed rules).

In the coming days, Illinois REALTORS® legal team will provide members with more information about the potential impact on their businesses of the proposed RELA administrative rules changes, which will not go into effect until after a public comment period, which will take a minimum of 90 days (probably longer), review by the Joint Committee on Administrative Rules and then formal adoption.

About the writer: Anneliese Fierstos is the Illinois REALTORS® Legal Hotline Attorney.

Create professional development programs that help REALTORS® strengthen their businesses.

Create professional development programs that help REALTORS® strengthen their businesses.

Protect private property rights and promote the value of REALTORS®.

Protect private property rights and promote the value of REALTORS®.

Advance ethics enforcement programs that increase REALTOR® professionalism.

Advance ethics enforcement programs that increase REALTOR® professionalism.

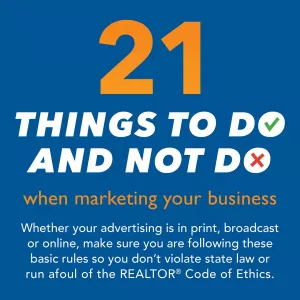

Protect REALTORS® by providing legal guidance and education.

Protect REALTORS® by providing legal guidance and education. Stay current on industry issues with daily news from Illinois REALTORS®, network with other professionals, attend a seminar, and keep up with industry trends through events throughout the year.

Stay current on industry issues with daily news from Illinois REALTORS®, network with other professionals, attend a seminar, and keep up with industry trends through events throughout the year.