In recent decades, no matter what the trending issues are in the Illinois General Assembly, there is one topic that always generates a great deal of legislation and discussion: property taxes. As we close out 2022, let’s take a look at some of the legislation—and proposals for possible solutions—aimed at addressing some aspect of the state’s property tax system.

Know your moving options

The latest twist in this age-old issue comes from none other than REALTOR® and state Rep. Mark Batinick from Plainfield. Batinick has served in the Illinois House since 2015, but decided not run for re-election this time. While we hate to see him go, we appreciate his ingenuity, problem-solving tenacity and his willingness to reach across the aisle.

Unveiled in September, the “Batinick Plan”, is a 23-year plan to reduce property taxes by 50 percent…quite a lofty goal! In short, the Batinick Plan uses the fact that Illinois is finally beginning to get the state’s unfunded pension liability in order, allowing for it to transition some of its budget burden to property tax relief.

In other words, the hard-fought economic reforms have Illinois on a downward slope in terms of the percentage of the state budget going towards pensions. The pension share peaked at nearly 30 percent in FY2017. By next year, it is scheduled to take no more than a 23 percent share.

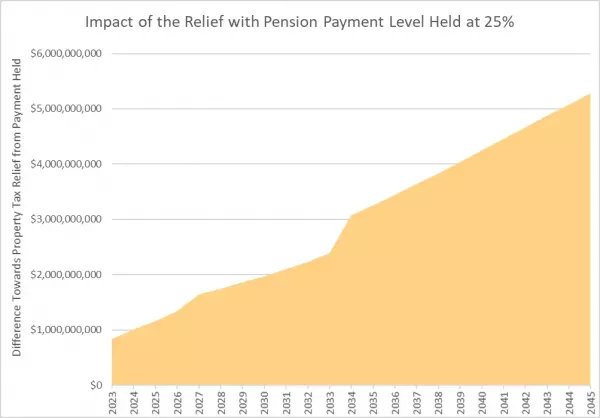

Batinick’s proposal would earmark 25 percent of the state’s general revenue fund (GRF) budget towards pensions and a new property tax relief component. The idea is that the 25 percent flat payment would become an automatic allocation as part of the base when beginning to look at the state budget. As the state continues to pare down the unfunded pension liability, the share of that 25 percent going towards property tax relief would increase.

The set-aside for property tax relief would be distributed to local school districts on a per-pupil basis, and the local school district would adjust its levy on a dollar-for-dollar basis to accomplish true property tax relief.

Batinick estimates that if the plan were in place right now, it would generate $1 billion to be distributed as property tax relief. If the plan were kept in place, by FY2045 over $5 billion in property tax relief would be distributed.

Like any new idea, especially those involving schools and property taxes, there will be critics and those who try to determine who the winners and losers will be based on whatever relief system is put in place. Aside from the natural who-gets-more/who-gets-less issue that is inherent in the per-pupil or any fund allocation method, another key factor will be ensuring “dollar for dollar” relief in the tax levy. For instance, back when the state enacted “property tax caps” 20 years ago, there were immediate and successful efforts by taxing districts to erode the caps by pursuing “emergency” or “special” exceptions, which became so prevalent, it really watered down the impact of the “caps.” But let’s at least have the conversation about the issue and the proposal. Bravo, Rep. Batinick!

Illinois REALTORS® thanks Rep. Batinick for his years of service in the state legislature and for being a great champion for the REALTOR® voice over the years.

“Instead of letting future pension payment savings be spent on legislator pet projects, let’s target those savings towards property tax relief that will result in additional investment in communities and relief in everyone’s pocket. Let’s solve the property tax issue with a strong foundation of pension reform.”

Illinois REALTORS® Manager of State Government Affairs Jim Clayton talks about the 2022 Veto Session, gives a preview of the upcoming new class of lawmakers making their way to Springfield and details the issues the Governmental Affairs Team is looking at in the next legislative year.

More Property Tax and Assessment Measures to Watch

Vacancy fraud bill could resurface in 2023

It appears proponents of a proposal to essentially make it a fraudulent act to simply own and hold commercial property without developing or marketing the property could pursue it again in the new session. In 2022, Sen. Laura Murphy sponsored such a bill (SB 3477). Illinois REALTORS® led a coalition of groups against the proposal this year, but we expect the Small Business Advocacy Council to push for it in the new General Assembly, which starts in January with a clean slate, at HB 1 and SB 1.

Cook County Assessor expected to push intrusive property assessment reform

Cook County Assessor Fritz Kaegi still talks of his desire to significantly change the assessment of commercial and industrial real estate in Cook County. The concept is to require property owners to send what some think is an intrusive amount of potentially highly sensitive data (income, expense and cash-flow data) about the property so Kaegi’s office can get a more accurate picture of what the property is worth for tax purposes based on its actual use and profitability. Illinois REALTORS®, along with a coalition of many other groups, currently opposes this legislation, but we will continue to work on this and other issues with Assessor Kaegi and other assessment officials throughout the state.

About the writer: Greg St. Aubin is Illinois REALTORS® Senior Vice President of Governmental Affairs.

Illinois REALTORS® Governmental Affairs Director Adriann Murawski is joined by Cook County Assessor Fritz Kaegi at the 2022 Fall Business Meetings where they discussed property tax complexity.

New Year, New Laws

Several real estate-related laws go into effect on Jan. 1, 2023

Shorter timeframe for condo HOAs to provide documents and caps document fees

House Bill 5246 (Public Act 102-0976), sponsored by Rep. Keith Wheeler and Sen. Meg Loughran Cappel, shortens the timeframe to no more than 10 days (rather than the current 30-day limit) for an HOA to provide copies of requested documents. And while current law limits the fee that HOAs are allowed to charge to the “actual cost” of providing the documents, this law will provide that the fee should not be more than $375.

Updates to the State Smoke Detector Mandate Effective Jan. 1, 2023

Back in 2017, Illinois REALTORS® spent a great deal of time negotiating reasonable updates to the Smoke Detector Act. At that time, the Illinois State Fire Marshal and the smoke detector industry sought updates to state law to reflect new smoke detector technology: primarily switching from replaceable battery detectors to self-contained, sealed battery detectors.

When all was said and done, we negotiated a bill with a five-year delayed effective date of Jan. 1, 2023, to ensure adequate time for the new technology to saturate the market. The new provisions require that “the battery is a self-contained, non-removable, long-term battery.”

The provision that detectors that are “wired into the structure’s AC power line” also qualify is retained in the new law. The new law also revises the penalty section of the Act, to establish a compliance-oriented system where a potential violator is given the opportunity to comply before fines and other sanctions are imposed.

The 2017 law also completely exempted the city of Chicago from the Act’s requirements, with the argument being that Chicago had already done its own unique, at-least-as-stringent law regarding smoke detectors. In 2021, Chicago also updated its own provisions dealing with the new type of self-contained smoke detector, but still retained its own version of penalties under the Act.