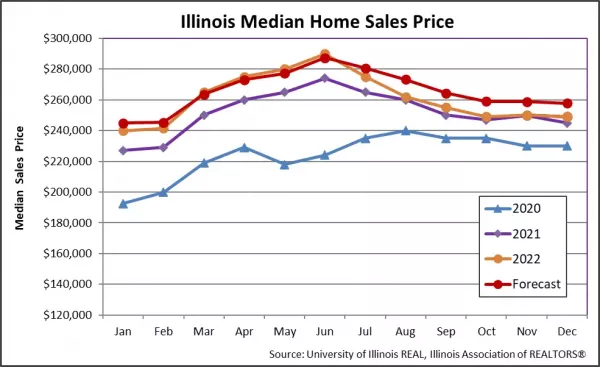

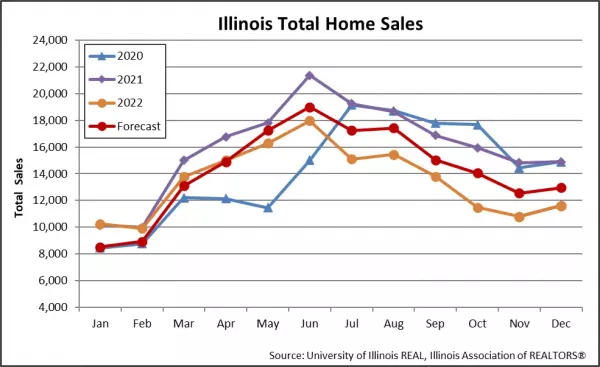

If 2022 was a year where the housing market began to recalibrate after a whirlwind 2021, then 2023 could end up being more of the same, according to some housing experts. Many of the issues triggering changes in the market – low inventory, higher mortgage rates, rising inflation – are expected to carry over into the new year.

“The rate of growth in house prices slowed in 2022 compared to the heights reached in 2021, while the number of sales remained low,” said Dr. Daniel McMillen, head of the Stuart Handler Department of Real Estate at the University of Illinois at Chicago College of Business Administration.

“Although uncertainty regarding interest rates and the rate of inflation makes the market difficult to predict, our forecast is that rates of growth in prices will be low throughout the first half of 2023, after which they are expected to rebound. The number of sales is forecast to be low in the Chicago area throughout 2023, but the number is expected in increase in the rest of Illinois during the second half of the year.”

Dr. McMillen and his team provide Illinois REALTORS® with monthly, quarterly and annual housing market forecasts. The full 2023 Illinois Forecast is now available.

The Illinois forecast at-a-glance:

- Median prices are forecast to grow throughout 2023 within a lower and narrower range compared to 2022. By December 2023, the median price in Illinois is forecast to be $257,700 (up 3.5 percent) while the median price for the Chicago Metro Area could be $312,900 (up 5.6 percent on an annual basis).

- Sales are forecast to experience mixed trends for both Illinois and the Chicago Metro Area. Statewide, sales will have negative growth in the first half of the year, but then shift to positive. In the Chicago Metro Area, however, there will be negative sales growth most of the year.