Written by Stephanie Sievers

Reading Time: 7 min

Three years after the COVID pandemic sent everyone home and upended the economy, much has returned to normal. Children are back in school, restaurants are full of diners and airlines and entertainment venues are packed.

But the evolution to more remote work, or even hybrid models where people come into the office only a few days a week, seems to have staying power and that trend continues to impact office space demand in Illinois and around the country.

With fewer people coming into the office, companies are re-evaluating how much office space they really need and what they should do with leases now that not all of their employees are in the office full-time. And all of that is having a negative impact on the office commercial sector.

U.S. office vacancy rates climbed to an all-time high of 13.1 percent in the second quarter of 2023, according to the National Association of REALTORS® July 2023 Commercial Real Estate Market Insights Report. Chicago, with a vacancy rate of 15.62 percent, ranks among the top 10 high vacancy areas in the country.

Illinois REALTOR® talked to some of the state’s leading commercial REALTORS® to learn more about the trends affecting different sectors of the market.

Collin Fischer

BarberMurphy Group

Antje Gehrken

A.R.E. Partners

Moses Hall

MoHall Commercial & Urban Development

Alex Ruggieri

North Star Equities

Deena Zimmerman

SVN Chicago

Office sector continues to struggle in many areas

Office is probably the weakest of the commercial sectors right now, says REALTOR® Alex Ruggieri, senior adviser with North Star Equities in Savoy.

It would be expected that metro areas, with miles of high-rise office space, would feel the pinch, but the push to downsize to a smaller footprint is being felt everywhere, he says.

Ruggieri was working with a rural county health department and helped them find a new building, but the county board slowed the project, asking them to do a study to determine how many employees could be switched to remote work so they could get a smaller building.

Tenants locked into leases with more space than they need are searching for ways to better utilize it. REALTOR® Moses Hall, founder and managing broker of MoHall Commercial & Urban Development in Chicago, estimates that space needs have dropped by at least 10 percent.

More companies are consolidating their operation footprint and subleasing the additional office space to others. Others have begun offering better amenities to entice employees to come into work more often. That can mean offering rooftop space, a gym and providing food on site, Hall says.

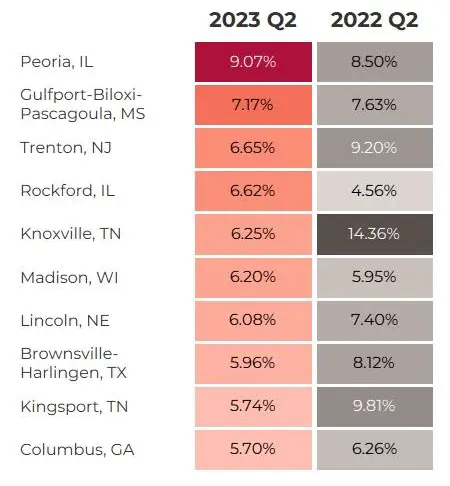

Top 10 areas with the largest office space vacancy rates

Source: NAR analysis of CoStar data

In southern Illinois, REALTOR® Collin Fischer, a principal with BarberMurphy Group in Shiloh, said the office space market in his area has largely been steady but he has seen the trend of tenants using the market reshuffling to move into higher quality buildings.

“You had some users who are in a Class B building take advantage and move up to a Class A facility because they know it’s going to help them attract the talent they want,” Fischer said.

In areas where there has been greater impact, one result is a drop in property values.

“We’re seeing a trend where a lot of office buildings are trading at substantially lower levels and some are just turning the keys back over to the lender,” Hall says.

In July, Crains Chicago Business reported that the owner of an office complex near O’Hare International Airport walked away from the property and handed it back to the lender even though the buildings were nearly fully occupied.

Multifamily sees rent growth

Multifamily has been one of the stronger commercial sectors, driven by housing demand, job growth and rising mortgage rates but it is beginning to return to pre-pandemic levels, according to the NAR Insights Report.

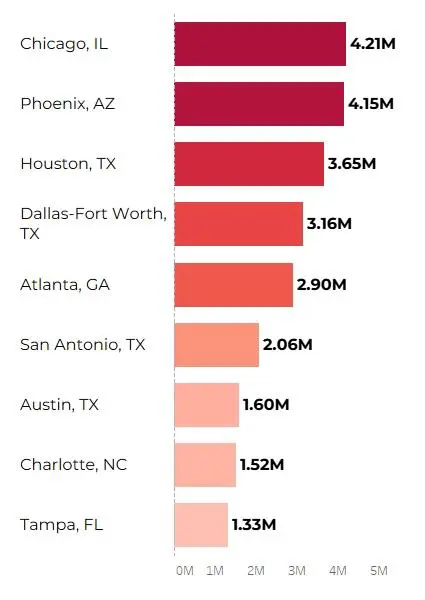

Top 10 areas with fastest rent growth

Source: NAR analysis of CoStar data

In the second quarter of 2023, multifamily rents climbed higher in many areas including Peoria and Rockford, which both made the report’s top 10 areas with the fastest growing rent, averaging 9.07 percent and 6.62 percent respectively.

REALTOR® Antje Gehrken, president and designated managing broker of A.R.E. Partners in Chicago, works with multifamily clients and says properties are getting snapped up quickly when they come on the market. Even smaller or distressed multifamily properties are in demand. People who might have been looking for single-family homes but can’t find one because of the limited inventory are considering two- to four-unit sites they can rent out.

One overlap of two potential commercial sectors that Gehrken is watching is the potential adaptive reuse and repurposing of unused office space into multifamily housing. It would take construction and money to reimagine and retrofit office space, but it could help fill some of the need for additional housing.

Retail remains red hot

The retail sector nationally and locally is booming, says REALTOR® Deena Zimmerman, Vice President, SVN Chicago Commercial and SVN National Retail Product Council Co-Chair.

In fact, Chicago tops the list of areas with the strongest net absorption in the past year, according to the NAR Insights Report. Retail demand is strong and currently has the lowest vacancy rate of any commercial sector, the report adds.

Zimmerman says anything related to health and wellness (med spas, pharmacies and boutique fitness) are doing particularly well. So are discount retailers. Despite the proliferation of online shopping options, people of all generations still like to go into brick-and-mortar stores to see merchandise in person and that bodes well for the retail sector, she says.

Even the iconic Radio Flyer wagon company sees a benefit to retail space. The 106-year-old company recently announced that it would be opening its first-ever retail store in Schaumburg later this year.

2023 has been a strong year for retail and Zimmerman predicts that 2024 could be even better.

Top 10 areas with the strongest net absorption in the last 12 months

Source: NAR analysis of CoStar data

Industrial boom beginning to moderate

Top 10 areas with the strongest 12-month absorption

Source: NAR analysis of CoStar data

Supply chain disruptions during the pandemic prompted an influx of industrial building and demand. After climbing to record highs, the industrial sector has slowed somewhat from that level but remains strong.

Some companies are moving manufacturing to the U.S. and there is a greater need for distribution and logistics centers, Ruggieri says. The self-storage sector is also doing well now, he says.

Nationally, industrial rent prices had the most rapid growth rate of all the commercial sectors and have increased faster than before the pandemic, according to the NAR Insights Report.

Hotel and hospitality sector see increased revenues

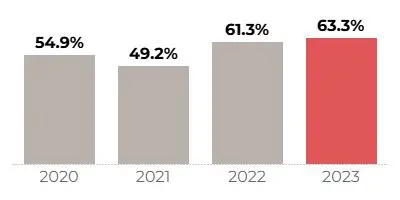

Hotel demand is up with occupancy fully recovered to pre-pandemic levels, according to the NAR Insight Report. That growing demand has boosted average daily room rates by 25 percent since 2020.

The report also projects that “as both business and leisure travel pick up, the demand for hospitality spaces is expected to keep increasing throughout 2023.

Note: All charts highlighted in this article are from the National Association of REALTORS® July 2023 Commercial Real Estate Market Insights Report

About the writer: Stephanie Sievers is Illinois REALTORS® Director of Marketing.

12-month Occupancy Rate in June