Written by Stephanie Sievers

Reading Time: 4 min

More than half a century has passed since the federal Fair Housing Act was signed into law but, Black homeownership continues to be hindered by some of the same historic roadblocks: bias, outdated credit scoring, discriminatory appraisals, higher loan denial rates and more.

In 2022, only 45.3 percent of Black households owned their homes compared to 74.6 percent of White households, according to the National Association of Real Estate Brokers (NAREB), the nation’s oldest trade association for Black real estate professionals.

Each year, NAREB releases its State of Housing in Black America, or SHIBA report, which takes an in-depth look at the Black homeownership rate in the U.S., existing hurdles and possible solutions. The conclusion is clear—more must be done to boost the homeownership rate of Black Americans.

NAREB President Lydia Pope on the “2022 State of Housing in Black America: The Elusive Dream of Black Homeownership” Report

Our annual State of Housing in Black America (SHIBA) report provides a comprehensive analysis of Black homeownership and the historic barriers we face when seeking to purchase a home and gain wealth. It is unacceptable that a typical White family has eight times the wealth of a Black family of similar stature.

The median net worth for Black households is $24,000 compared to $188,000 for White families. The major driver of intergenerational wealth for Blacks is homeownership. And the data tells us why the wealth gap is so large.

Homeownership for Blacks has dropped nearly 20 percent since 2008 and despite enactment of 1968 Fair Housing Act, the homeownership gap has widened since the law was enacted.

-

In 2022, 74.6 percent of White households owned their homes, compared with 45.3 percent of Black households—a gap of more than 29 points.

-

In 1960, the White homeownership rate was 65 percent, and the Black rate was 38 percent, a 27-point gap.

For our nation to achieve the goal of equity for all communities, steps must be taken by the public and private sectors to increase Black homeownership. The need for this government assistance should be seen through the lens of what is owed from the discriminatory government practices after WWII, when most benefits of the GI Bill to denied to Blacks. During this time period, White homeownership expanded, Blacks were excluded from the growth, and these biased actions are what has contributed to the low homeownership for Blacks today.

NAREB President Lydia Pope

Five Findings from the Report

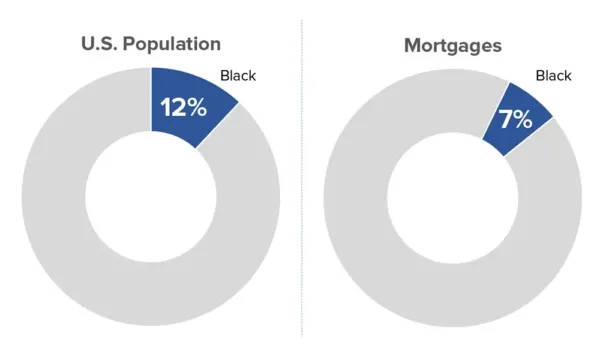

1. Black borrowers still represent a smaller share of mortgage originations – Blacks represent 12 percent of the U.S. population, but they receive only 7 percent of all mortgage originations. By contrast, loan originations to White borrowers account for 56 percent of all loans.

Source: 2022 State of Housing in Black America

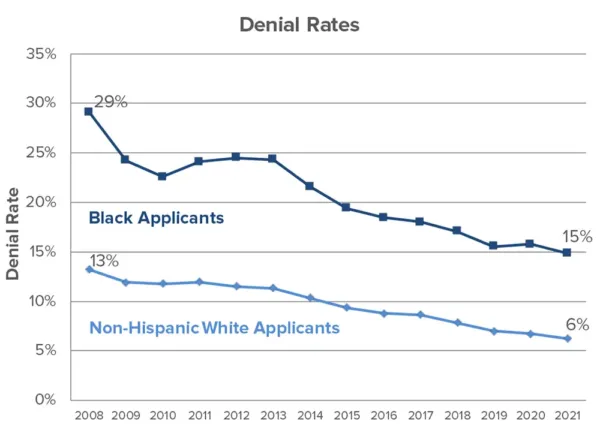

2. Black applicants continue to experience higher loan denial rates than their White counterparts. Black homebuyers are also more likely (14 percent) to receive high-cost loans compared to White homebuyers (5 percent).

Source: Authors’ calculations of HMDA data (2008-2021)

3. Black loan applicants had a 20 percent denial rate at banks compared to 8 percent for White applicants. Denial rates are more than twice as high for Black applicants in majority minority neighborhoods (16 percent) than for White applicants in similar neighborhoods (7 percent).

Source: 2022 State of Housing in Black America

4. Female borrowers account for 42 percent of Black mortgage applicants compared to 34 percent male.

5. While millennials make up the largest segment of Black homebuyers since the COVID-19 pandemic, their homeownership rate lags behind previous generations. Black college graduates have less than one-tenth the wealth of their White counterparts.

Solutions

Eliminate loan level price adjustments – The adjustments penalize populations already disproportionately impacted by discriminatory or exploitative lending.

Eliminate penalty fees for borrowers to access down payment assistance – Charging higher fees to those qualifying for down payment assistance contradicts the idea of decreasing the cost of the loan.

Recalculate the impact of student loan debt – Re-examine the standard that deferred student loan debt repayments be included in a buyer’s debt-to-income ratio.

Leverage special purpose credit programs – Increase the use of these programs aimed at offering alternative funding options for underserved communities.

End discriminatory and abusive appraisal practices – Research has shown that homes in Black communities have often been historically undervalued. More must be done to promote fair housing training and encourage more people of color to enter the profession.

Fix the broken and out-of-date housing finance system – Allow Fannie Mae and Freddie Mac to pursue housing and community development ideas that are better equipped to deal with the renovation and replacement needs of older, urban communities.