As negotiations for the state’s financial bailout plan (Senate Bill 2505) progressed in the waning hours of the lame duck General Assembly, the Illinois Association of REALTORS® noted last-minute language labeled “property tax relief” filed on Jan. 11.

After review of the proposal, IAR determined it was not in the interest of property owners and swiftly testified against it, working to educate lawmakers on the negative effects of the bill. Ultimately the Illinois House removed the proposal from the bill and passed it last night; the Senate followed suit in the early hours this morning.

The bill heads to the Governor for signature; among the measures are an increase in the state personal income tax from 3 to 5 percent, an increase in the corporate income tax from 4.8 to 7 percent, and ultimately no changes to the state income tax credit for property taxes.

As proposed in Senate Bill 2505, the so-called “property tax relief” provision would have completely deleted the provision in law now which provides for an Illinois income tax credit for property taxes paid and would have replaced it with a provision that would have provided each homeowner who files an Illinois income tax return by April 15th of each year gets a proportionate share of monies in the Property Tax Rebate Trust Fund. The Fund is funded by the proceeds of one-quarter of one percent of income tax proceeds from the individual income tax. Some estimated that, using current homeownership rates and income tax revenues, these “rebates” would amount to about $325 per taxpayer. Learn more about the negative impact such a proposal would have had on property owners at www.illinoisrealtor.org.

IAR will continue to monitor proposals affecting property owners and the real estate industry as the 97th Illinois General Assembly begins work today.

Create professional development programs that help REALTORS® strengthen their businesses.

Create professional development programs that help REALTORS® strengthen their businesses.

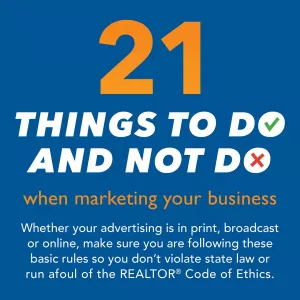

Protect private property rights and promote the value of REALTORS®.

Protect private property rights and promote the value of REALTORS®.

Advance ethics enforcement programs that increase REALTOR® professionalism.

Advance ethics enforcement programs that increase REALTOR® professionalism.

Protect REALTORS® by providing legal guidance and education.

Protect REALTORS® by providing legal guidance and education. Stay current on industry issues with daily news from Illinois REALTORS®, network with other professionals, attend a seminar, and keep up with industry trends through events throughout the year.

Stay current on industry issues with daily news from Illinois REALTORS®, network with other professionals, attend a seminar, and keep up with industry trends through events throughout the year.