Nearly 12 years ago, the Lake County cities of Highland Park and Highwood signed an intergovernmental annexation agreement paving the way for a brand new development on the site of a decommissioned military base. The development, known as Fort Sheridan, now fully built and occupied, is split between both municipalities. One provision of the intergovernmental agreement extended Highland Park’s pre-existing real estate transfer tax (RETT) of $5 per $1,000 of a home’s purchase price to all of Fort Sheridan, including the Highwood portion even though the rest of Highwood did not and does not have a RETT.

REALTOR® Government Affairs and Highwood REALTORS® long criticized the Highwood/Fort Sheridan RETT as an unlawful way to get around existing state law which only allows home rule municipalities that receive voter approval via a referendum to implement a RETT. Highwood, at the time, was not home rule and it did not place a transfer tax referendum on the ballot. REALTORS® also pointed out the adverse consequences of a RETT and the inequity of a municipality mandating a transfer tax on only one portion of a community.

On December 6—three mayors and numerous aldermen later—the Highwood City Council unanimously passed a resolution imposing a moratorium on the collection of a real estate transfer tax on Fort Sheridan properties within the city of Highwood. The resolution, sponsored by fourth ward Aldermen Eric Falberg and James Levi, imposes a moratorium, effective January 1, 2012, on the Fort Sheridan transfer tax and directs the city manager and city attorney to amend the intergovernmental annexation agreement (the agreement that initiated the tax) to permanently eliminate the tax.

Home sellers in Highwood portion of the subdivision will no longer be encumbered with the $5/$1,000 tax which comes out to $1,500 on a $300,000 sale.

Transfer taxes are known anecdotally and empirically to adversely impact real estate. In one study, the C.W. Howe Institute found that Toronto’s transfer tax, after just one year of implementation, “has had significant negative effects on the housing market, including reducing sales and lowering average house prices.”

“After all these years it’s hard to believe that this issue has concluded,” said Terry Penza, president and chief executive officer of the North Shore-Barrington Association of REALTORS®. “But it’s a healthy reminder for us [REALTORS®] not to give up when the going gets tough but to continue our advocacy for private property rights and a vibrant real estate market.”

Ninety-five percent (95%) of Illinois municipalities do not maintain a real estate transfer tax; of those that do, the vast majority are in Chicagoland. Homes within the city of Highland Park portion of Fort Sheridan will still be subject to the tax.

And while it took 12 years to make things right for Highwood residents, Illinois REALTORS® wage these battles over burdensome taxes on residential, commercial, agricultural, and industrial real estate every year in communities across the state.

Howard Handler is the Illinois Association of REALTORS® local Government Affairs Director (GAD) representing North Shore-Barrington Association of REALTORS® and Lake County for the Mainstreet Organization of REALTORS®.

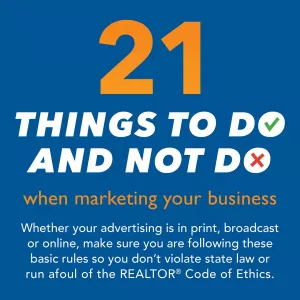

Create professional development programs that help REALTORS® strengthen their businesses.

Create professional development programs that help REALTORS® strengthen their businesses.

Protect private property rights and promote the value of REALTORS®.

Protect private property rights and promote the value of REALTORS®.

Advance ethics enforcement programs that increase REALTOR® professionalism.

Advance ethics enforcement programs that increase REALTOR® professionalism.

Protect REALTORS® by providing legal guidance and education.

Protect REALTORS® by providing legal guidance and education. Stay current on industry issues with daily news from Illinois REALTORS®, network with other professionals, attend a seminar, and keep up with industry trends through events throughout the year.

Stay current on industry issues with daily news from Illinois REALTORS®, network with other professionals, attend a seminar, and keep up with industry trends through events throughout the year.