Economist Geoff Hewings told REALTOR® association leaders gathered yesterday in Bloomington for the IAR Public Policy Meetings that the economy must improve before we’ll see a recovery in the housing market and Illinois’ unemployment levels have been below the last employment peak in 2000 for the last 10 years. In his presentation “Monitoring the Illinois Economy: When Will It Get Better?” Hewings, director of REAL (Regional Economics Applications Laboratory), said Illinois will take longer than the nation to recover from this recession.

“Remember the lost decade in Japan?” asked Hewings. “We are rapidly approaching that.”

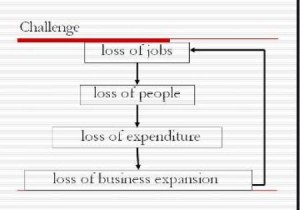

This chart from his presentation shows the cycle related to job losses. Business expansion and investment are critical to improve the job situation and the overall economy. Hewings noted that Illinois has dropped from 4th to 15th in terms of per capita income in the last 15 years and likely we will see continued erosion of the state’s competitive position. Illinois has only experienced three years since 1980 when employment growth rate exceeded the United States and all were before 1990.

This chart from his presentation shows the cycle related to job losses. Business expansion and investment are critical to improve the job situation and the overall economy. Hewings noted that Illinois has dropped from 4th to 15th in terms of per capita income in the last 15 years and likely we will see continued erosion of the state’s competitive position. Illinois has only experienced three years since 1980 when employment growth rate exceeded the United States and all were before 1990.

“Even if Illinois’ economy turns around in 2010, it would still take a minimum of 8 years to reclaim 2000 unemployment levels,” said Hewings. “Illinois has added jobs at 40 percent the rate of the United States.”

Home sales, he says, will continue to chug along with first-time buyers motivated by the tax credit, Illinois typical turnover of 11 percent a year, job relocation and retirements prompting sales. But in an economy that is not growing jobs or business expansion, fewer people will be changing jobs.

“People are voting with their feet,” said Hewings. “Net migration drains $1.6 billion from the state’s economy each year.”

Positive year-over-year home sales are forecast for the first quarter of 2010 statewide and in the Chicagoland region while median prices are expected to decline 6 to 7 percent.

“While some months a market may be up, the next down, we see this volatility as a sign that the housing market may be bottoming out, certainly in some areas of the state” said Hewings. “The downward trends we’ve seen in the last several years are ending. But for Illinois, unless the fiscal crisis is addressed, there is little prospect that growth rates will match those for the United States.”

Create professional development programs that help REALTORS® strengthen their businesses.

Create professional development programs that help REALTORS® strengthen their businesses.

Protect private property rights and promote the value of REALTORS®.

Protect private property rights and promote the value of REALTORS®.

Advance ethics enforcement programs that increase REALTOR® professionalism.

Advance ethics enforcement programs that increase REALTOR® professionalism.

Protect REALTORS® by providing legal guidance and education.

Protect REALTORS® by providing legal guidance and education. Stay current on industry issues with daily news from Illinois REALTORS®, network with other professionals, attend a seminar, and keep up with industry trends through events throughout the year.

Stay current on industry issues with daily news from Illinois REALTORS®, network with other professionals, attend a seminar, and keep up with industry trends through events throughout the year.