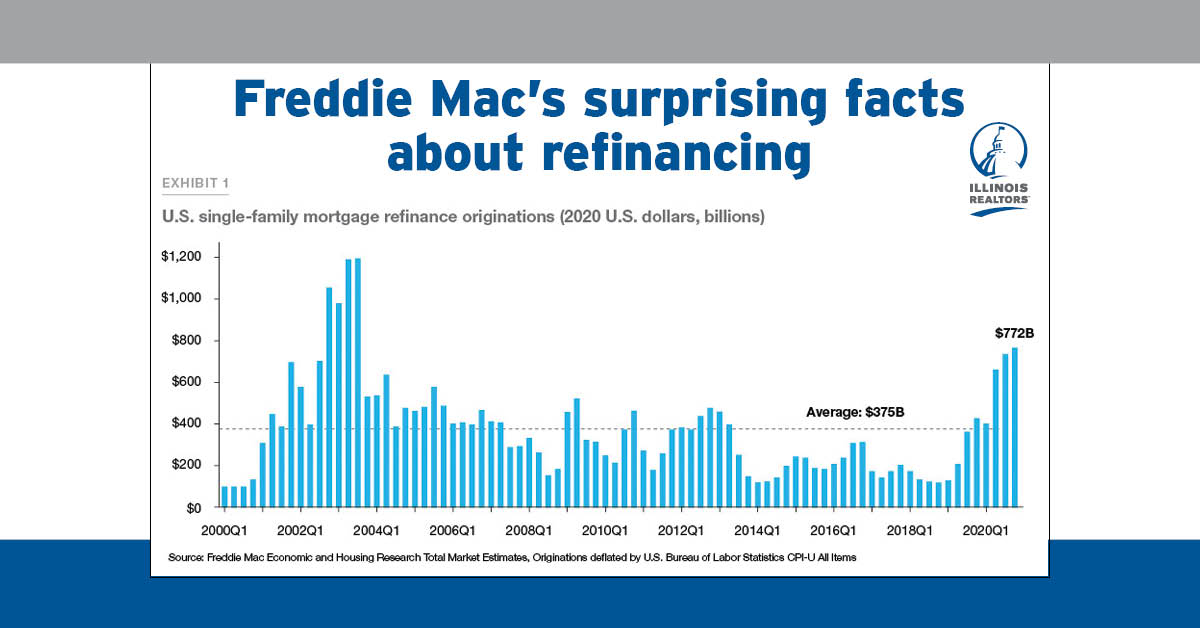

As mortgage interest rates fell throughout 2020, 10.1 percent of refinances were “repeat refinances,” according to research from Freddie Mac. In other words, the loans were refinanced two or more times in a 12-month period. In 2019, 7.8 percent of refinances were repeats, while 16.6 were repeats in 2003.

On average, consumers who refinanced a 30-year fixed rate mortgage into another 30-year fixed rate mortgage saved more than $2,800 in annual mortgage payments.

Also, during the first quarter of 2020, about 24 percent of borrowers shortened the term of their loans. About 98 percent of refinancing borrowers chose fixed-rate loans. For more information, go to: bit.ly/FreddieMac_Refinance

Create professional development programs that help REALTORS® strengthen their businesses.

Create professional development programs that help REALTORS® strengthen their businesses.

Protect private property rights and promote the value of REALTORS®.

Protect private property rights and promote the value of REALTORS®.

Advance ethics enforcement programs that increase REALTOR® professionalism.

Advance ethics enforcement programs that increase REALTOR® professionalism.

Protect REALTORS® by providing legal guidance and education.

Protect REALTORS® by providing legal guidance and education. Stay current on industry issues with daily news from Illinois REALTORS®, network with other professionals, attend a seminar, and keep up with industry trends through events throughout the year.

Stay current on industry issues with daily news from Illinois REALTORS®, network with other professionals, attend a seminar, and keep up with industry trends through events throughout the year.