Mortgage loan modifications through Fannie Mae and Freddie Mac could get easier beginning July 1, under a simplified process that eliminates the requirement that homeowners to first provide financial and hardship documentation.

Under the new Streamlined Modification Initiative, borrowers who are at least 90 days delinquent on their mortgage will automatically be eligible for a modification, which will be made permanent after they make three on-time payments as part of a trial period, the Federal Housing Finance Agency (FHFA) announced this week. The program will expire Aug. 1, 2015.

“The Streamlined Modification Initiative adds to the suite of home retention tools offered byFannie Mae and Freddie Mac,” said FHFA Acting Director Edward J. DeMarco in a statement. “This new option gives delinquent borrowers another path to avoid foreclosure. We will still encourage such borrowers to provide documentation to support other modification options that would likely result in additional borrower savings.”

Create professional development programs that help REALTORS® strengthen their businesses.

Create professional development programs that help REALTORS® strengthen their businesses.

Protect private property rights and promote the value of REALTORS®.

Protect private property rights and promote the value of REALTORS®.

Advance ethics enforcement programs that increase REALTOR® professionalism.

Advance ethics enforcement programs that increase REALTOR® professionalism.

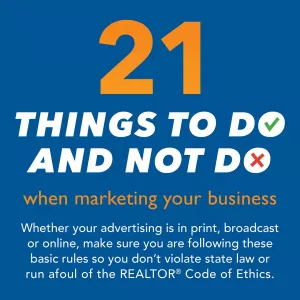

Protect REALTORS® by providing legal guidance and education.

Protect REALTORS® by providing legal guidance and education. Stay current on industry issues with daily news from Illinois REALTORS®, network with other professionals, attend a seminar, and keep up with industry trends through events throughout the year.

Stay current on industry issues with daily news from Illinois REALTORS®, network with other professionals, attend a seminar, and keep up with industry trends through events throughout the year.