Consequences of Home Rule? Higher property taxes, fees and debt

Illinois REALTORS® is working hard to oppose several municipal referenda, involving Home Rule and the Real Estate Transfer Tax in the upcoming Election.

by Mike Scobey, Illinois REALTORS®

Senior Director of Local Advocacy & Global Programs

Home Rule is being sought in five referenda that will appear on the November 6th ballot. These municipalities are:

- Prospect Heights (Cook County)

- Winthrop Harbor

- Beach Park

- Zion (all Lake County)

- Lemont (Will County)

While Home Rule gives municipalities more local autonomy, when Home Rule powers are misused, it can negatively impact real estate and private property owners. Illinois REALTORS® is the only advocate for private property rights at the State Capitol in Springfield and in city and village halls across Illinois. That is why we intend to educate the communities about the unintended consequences of home rule. Our campaigns involve direct mail and other voter outreach methods.

Why do Illinois REALTORS® oppose Home Rule? We have seen abuses of home rule power in some municipalities.

- We oppose the increased debt for local governments that Home Rule allows.

- We oppose higher property taxes without voter approval that comes with home rule.

- We oppose the additional regulations, red tape and fees on real estate transactions that Home Rule authority allows.

- We oppose possible new and excessive property inspections and fees which home rule authority can impose.

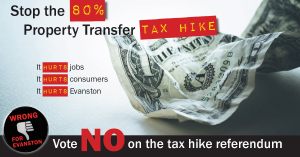

Two municipalities that have Home Rule power will have a Transfer Tax Referendum on the November ballot.

Two municipalities that have Home Rule power will have a Transfer Tax Referendum on the November ballot.

The City of Evanston is proposing to increase its existing transfer tax from the current rate of $5 per thousand to $7 per thousand for properties with purchase prices over $1.5 million and up to $5 million. Properties over $5 million will have a rate of $9 per thousand. This will increase the cost of doing business in Evanston and harm prospects for economic development.

This kind of graduated transfer tax would be the first of its kind in Illinois. Illinois REALTORS® strongly opposing this measure.

Also, being opposed by Illinois REALTORS® is a first-time transfer tax in the Village of Bannockburn. The Village is seeking a $1 per thousand transfer tax on all property transfers and the liability would be on the Buyer.

In addition to referenda that we are opposing, Illinois REALTORS® is supporting a one-cent sales tax in Frankfort (Will County) to help fund infrastructure improvements and a one-cent sales tax in Sangamon County to help fund elementary and secondary school districts.

About the writer: Mike Scobey is Illinois REALTORS® Senior Director of Local Advocacy & Global Programs.

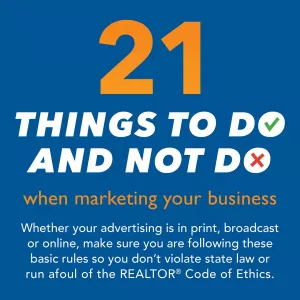

Create professional development programs that help REALTORS® strengthen their businesses.

Create professional development programs that help REALTORS® strengthen their businesses.

Protect private property rights and promote the value of REALTORS®.

Protect private property rights and promote the value of REALTORS®.

Advance ethics enforcement programs that increase REALTOR® professionalism.

Advance ethics enforcement programs that increase REALTOR® professionalism.

Protect REALTORS® by providing legal guidance and education.

Protect REALTORS® by providing legal guidance and education. Stay current on industry issues with daily news from Illinois REALTORS®, network with other professionals, attend a seminar, and keep up with industry trends through events throughout the year.

Stay current on industry issues with daily news from Illinois REALTORS®, network with other professionals, attend a seminar, and keep up with industry trends through events throughout the year.